As quantum computing advances from theoretical concept to technical reality, its implications for blockchain security are becoming increasingly urgent. Cryptocurrencies, built on cryptographic assumptions vulnerable to quantum algorithms, face both a structural and narrative threat. We examine the technical, operational, and psychological dimensions of quantum risk in the crypto ecosystem and explore whether the next quantum leap will fortify blockchain infrastructure — or trigger an unprecedented market collapse

Recent advances in quantum computing have reignited longstanding concerns about the future of blockchain security and the resilience of digital assets. As the theoretical capabilities of quantum systems inch closer to practical realization, the cryptocurrency sector faces a unique convergence of technical risk and market psychology. A breakthrough in quantum computation — especially in areas like qubit stability, fault-tolerant architectures, or algorithmic optimization — could potentially expose the cryptographic primitives that underpin most blockchain protocols today. While such developments may still be years from full deployment, the implications are significant enough to merit strategic preparation and, more urgently, a re-evaluation of the narratives that drive investor behavior in crypto markets.

At the core of the issue lies the cryptographic model that secures modern blockchain systems. Protocols like Bitcoin, Ethereum, and countless others rely heavily on elliptic curve cryptography (ECC) and RSA for secure key generation, transaction authentication, and consensus mechanisms. These cryptographic schemes were designed under the assumption that adversaries would be limited to classical computational models, where factoring large prime numbers or solving discrete logarithm problems would require infeasible timeframes. However, quantum algorithms such as Shor’s algorithm threaten to invalidate this security model entirely. Shor’s algorithm, when run on a sufficiently powerful quantum computer, can solve both of these problems exponentially faster than classical algorithms, rendering many widely used cryptographic schemes obsolete.

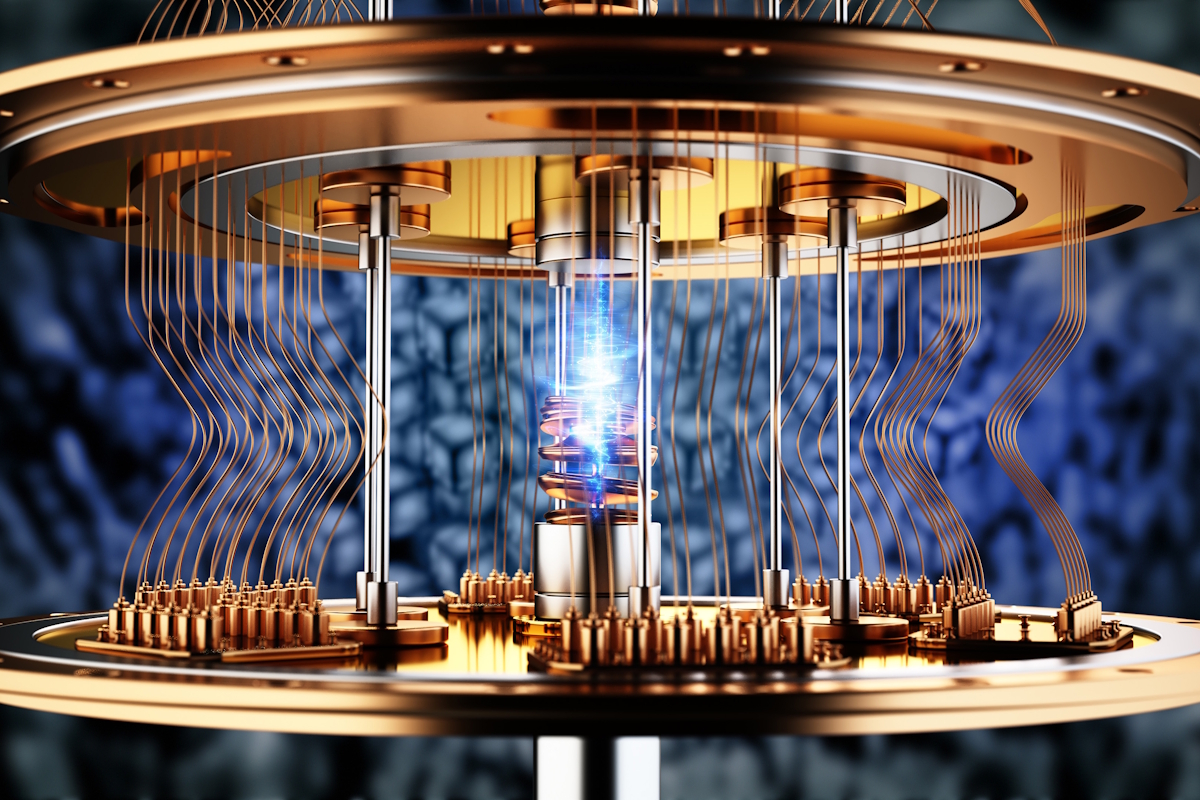

Although today’s quantum computers remain well below the threshold required to pose a real-time threat to public key cryptography, the progress in the field has been consistent and non-linear. As of 2025, major players such as Google, IBM, and research institutions globally have achieved steady advancements in quantum error correction, qubit coherence, and scalability. While we are not yet in the era of fault-tolerant, large-scale quantum computation, the path toward that goal is clearer than ever. This has led to increased urgency within the blockchain community to evaluate and, where possible, begin transitioning toward quantum-resistant cryptographic systems — a discipline broadly referred to as post-quantum cryptography (PQC).

However, the threat quantum computing poses is not solely technical in nature. Markets are driven as much by perception as by objective reality. In the cryptocurrency ecosystem, where sentiment is particularly volatile and information dissemination is both rapid and opaque, a credible report or even a speculative narrative about the practical viability of quantum attacks could trigger widespread panic. The mere belief that quantum computers may be capable of compromising private keys could lead to mass withdrawals, on-chain instability, and precipitous price collapses — well before any actual exploit occurs. This type of reactionary behavior is amplified by the decentralized and often fragmented structure of the crypto ecosystem, where centralized coordination for crisis response is difficult if not impossible.

A particularly illustrative concern is the potential for “harvest now, decrypt later” attacks. In this model, malicious actors capture encrypted communications or blockchain data today, under the assumption that they can decrypt it in the future once quantum resources become available. While this does not immediately affect transaction integrity, it presents a critical risk to long-term confidentiality, especially for blockchains that have stored sensitive metadata or financial activity. This raises important questions about retroactive privacy loss and the lifespan of cryptographic commitments made under pre-quantum assumptions.

In response to these risks, the cryptographic and blockchain research communities have already begun developing and testing quantum-resistant algorithms. Post-quantum cryptographic schemes, such as lattice-based, multivariate polynomial, and hash-based cryptography, offer promising alternatives that are believed to be secure against known quantum attacks. The National Institute of Standards and Technology (NIST) in the United States has been leading a global standardization effort, recently selecting a first set of algorithms for public-key encryption and digital signatures that can replace vulnerable schemes.

Implementing these alternatives within existing blockchain infrastructure, however, is a formidable challenge. Legacy systems are not easily upgraded, particularly in decentralized environments where consensus must be achieved across disparate stakeholders including miners, validators, developers, exchanges, and end-users. Transitioning to post-quantum security often implies significant protocol-level changes that can affect wallet compatibility, smart contract functionality, and network performance. Moreover, poorly managed migrations risk causing chain splits, user confusion, or liquidity fragmentation — all of which could destabilize the ecosystem even in the absence of a real quantum threat.

Some blockchains are already experimenting with post-quantum signature schemes on testnets, and others are developing hybrid models where transactions require both classical and quantum-resistant signatures during a transitional period. Ethereum, for instance, has funded research into alternative cryptographic mechanisms, while newer protocols are exploring staged upgrade frameworks to minimize disruption. The key to a successful migration lies not just in technical feasibility, but in governance coordination and communication strategy. Without coherent messaging and ecosystem-wide planning, even the perception of weakness could result in unnecessary forks or exodus of capital.

Several future scenarios can be envisioned depending on how the ecosystem responds. In the most optimistic outcome, the crypto industry proactively integrates post-quantum cryptography ahead of any critical threshold. Through rigorous testing, open collaboration, and phased deployment strategies, major blockchains adapt in time to maintain user trust and systemic integrity. While such a transition would likely be accompanied by volatility, it would reinforce the industry’s resilience and technical maturity.

A less favorable but still manageable scenario involves a so-called “information shock,” where a vague or misunderstood announcement regarding quantum breakthroughs leads to irrational market behavior. In this case, the damage would stem more from narrative failure than from technical compromise. The industry’s ability to respond calmly and authoritatively — through developer communication, third-party audits, and clear upgrade timelines — would be crucial in containing the fallout.

The most destabilizing scenario combines a genuine quantum computational leap with inadequate industry preparation. Should malicious actors gain access to sufficiently powerful quantum systems before mitigation protocols are in place, selective attacks on exposed addresses or critical infrastructure — such as cross-chain bridges, custodians, or multisig wallets — could erode faith in the immutability of blockchains. Such an event would not only challenge the technical foundations of cryptocurrencies but also their legal and economic viability as secure value stores.

Quantum computing thus poses a dual threat to the cryptocurrency sector: one rooted in cryptographic obsolescence, and the other in market reflexivity. The evolution of quantum hardware may still be gradual, but its impact could manifest abruptly. For a sector that prides itself on decentralization and technological sovereignty, the quantum challenge represents a defining test — not only of code robustness, but of collective foresight.