As the European Union races toward its 2026 deadline for launching the European Digital Identity (EUDI) Wallet, uncertainty looms over its timely readiness. Despite ambitious goals and political momentum, technical delays, regulatory gaps, and uneven national progress threaten to derail the uniform rollout of this flagship digital identity initiative. With only a year remaining, the question is no longer if the wallet will arrive on time, but where, how, and to what extent it will actually function

Despite the official timeline set by the European Commission, the readiness of the European Digital Identity (EUDI) Wallet by the end of 2026 appears increasingly uncertain. As the deadline approaches with only a year remaining, a combination of technical, regulatory, and political complexities casts significant doubt on the feasibility of achieving a harmonized and functional deployment across all EU Member States. While the ambition behind the EUDI Wallet is grounded in the objective of creating a secure, interoperable digital identity system that supports cross-border transactions and user control over personal data, the reality of fragmented progress and evolving standards threatens to undermine its timely realization.

One of the clearest indicators of the project’s uneven trajectory is the divergence in national readiness levels. Countries like the Netherlands have already signaled their inability to meet the 2026 deadline. Malta anticipates delivering a wallet by that date, yet acknowledges it may lack full functionality. Bulgaria, meanwhile, represents a more extreme case of delay, where the state has yet to begin foundational work on a government-backed EUDI Wallet. As George Dimitrov, Chairman of the Board at Evrotrust, points out, this delay is primarily due to the absence of specific national legislation aligned with the EU regulatory framework, despite private sector readiness. The disparity among Member States reflects the differing baselines from which each country is operating. While some, such as Germany or Spain, benefit from mature eID infrastructures and existing digital identity ecosystems, others are still in the process of building essential registries and verifying attribute sources such as population, education, and corporate databases.

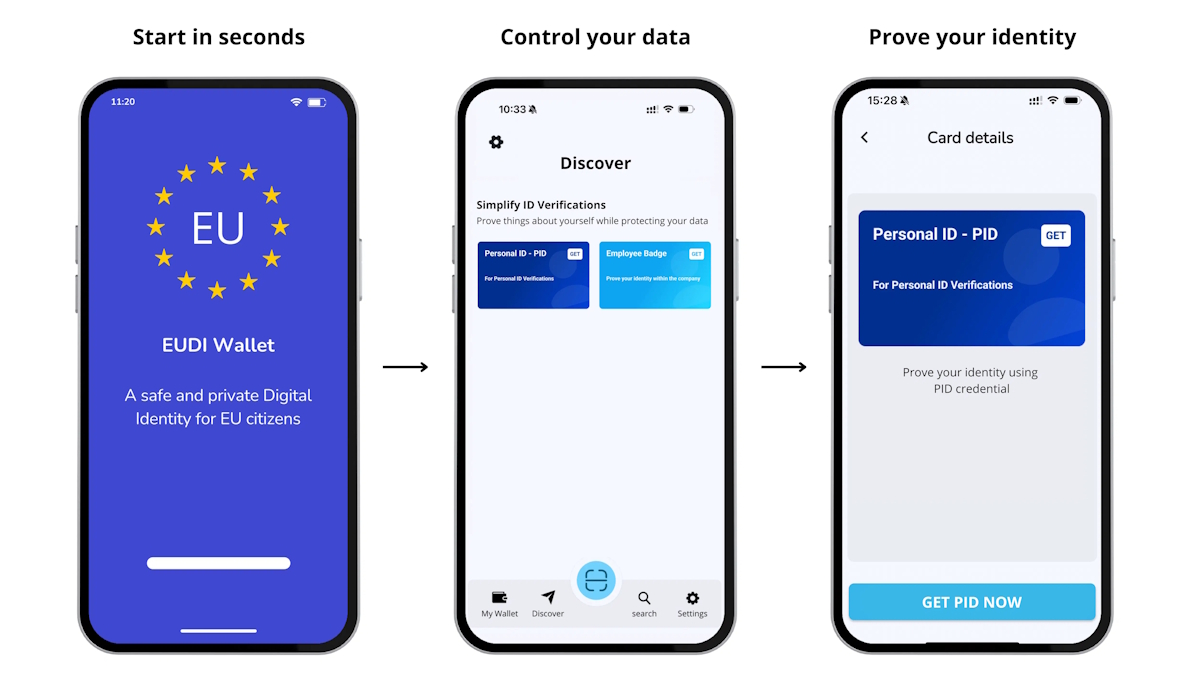

The challenge of integration further complicates national efforts. As Irene Hernandez, CEO of Gataca, observes, the technical and operational burden of ensuring compatibility between legacy systems and the new EUDI Wallet framework is substantial. In Spain, where the Royal Mint is responsible for overseeing the wallet’s development, developers must ensure seamless interoperability with existing tools such as Cl@ve and the national eID. This task is compounded by the requirement for digital wallets to support selective disclosure, verifiable credentials, and standardized protocols for wallet-to-verifier communication, all while maintaining the highest levels of privacy, security, and user control.

Beyond national disparities, systemic obstacles at the European level are exacerbating the situation. The European Union has yet to finalize all the technical specifications and implementing acts that underpin the initiative. The Architecture and Reference Framework (ARF), which defines the foundational structure for the wallet’s implementation, remains in flux. According to Richard Esplin, Head of Product at Dock Labs, developers across the EU are currently building against a backdrop of evolving and occasionally shifting technical standards, making it difficult to finalize stable, production-ready systems. Essential components such as assurance levels for digital credentials, certification requirements, and cross-border trust frameworks are still under development, introducing regulatory uncertainty into the software development lifecycle.

Certification is emerging as another critical bottleneck

The EUDI Wallet must conform to stringent security standards, and the process of certifying such compliance is lengthy, complex, and fragmented. National-level certification schemes and the accreditation of Conformity Assessment Bodies (CABs) are still being established, creating procedural delays. Without a harmonized and efficient pathway for certification, developers are hindered in their efforts to transition from pilot environments to operational deployment. This bottleneck, combined with the absence of a finalized EU-wide testing mechanism involving real-world issuers and relying parties, restricts the ability of wallet developers to validate their solutions under realistic conditions.

Despite these challenges, certain Member States continue to push forward. Germany, for example, remains one of the few countries optimistic about delivering a compliant wallet by the deadline. The German approach, according to the Federal Agency for Disruptive Innovation (SPRIND), is deliberately incremental. It emphasizes core capabilities, such as Personal Identification Data (PID) and Electronic Attestations of Attributes (EAA), with further functionalities scheduled for subsequent iterations. This staged rollout model reflects a pragmatic recognition of both the project’s technical depth and the operational challenges involved in large-scale deployment.

Projections from private sector actors such as Signicat suggest that by December 2026, Europe could witness the presence of between 30 to 50 distinct digital wallets. However, interoperability across these solutions will likely remain limited. According to Esther Makaay, Vice President of Digital Identity at Signicat, full integration across the digital identity ecosystem, including service providers and relying parties, will extend beyond 2026. In her assessment, the coming year will reveal much about each country’s roadmap, engagement strategies, and practical readiness, particularly in relation to cross-border use cases and digital credential issuance.

The European Commission has attempted to accelerate development through the deployment of several Large Scale Pilots (LSPs), including those led by the APTITUDE and WE BUILD consortia. These pilots have served to identify critical technical and operational gaps, but the transition from pilot outcomes to production-grade systems remains a protracted process. As Dimitrov notes, large-scale pilots offer valuable insights, but the real challenge lies in translating those insights into stable, certified products that can be adopted by the general public and integrated into public and private service infrastructures.

The final utility of the EUDI Wallet is inextricably linked to the quality and trustworthiness of the credentials it contains

Ensuring high assurance levels for sensitive attributes such as legal identity, educational qualifications, or professional licenses requires coordinated frameworks and mutual recognition agreements among issuing authorities across Europe. Without such coordination, the wallet risks becoming a fragmented tool, useful only within specific national contexts and failing to deliver on its promise of EU-wide functionality.

In light of these multifaceted obstacles, private sector solutions may be instrumental in bridging the implementation gap. Companies such as Gataca are positioned to accelerate deployment by offering modular, standards-compliant wallet solutions that governments can leverage. However, Hernandez cautions that full implementation across all intended use cases and sectors may not be realistic within the 2026 timeframe, with meaningful integration and adoption likely continuing into 2027 and beyond. This extended timeline reflects a broader consensus emerging across the digital identity ecosystem: while the EUDI Wallet remains a pivotal component of Europe’s digital transformation strategy, its path to maturity will be staggered, asymmetric, and highly dependent on both national preparedness and European regulatory alignment.